Capital One Walmart Rewards Credit Card

I lead the product design over a ten month period in 2019 for Walmart's largest company initiative of the year - the launch of a new credit card rewards program in partnership with Capital One. This was a once-in-ten-year opportunity and we needed to nail it.

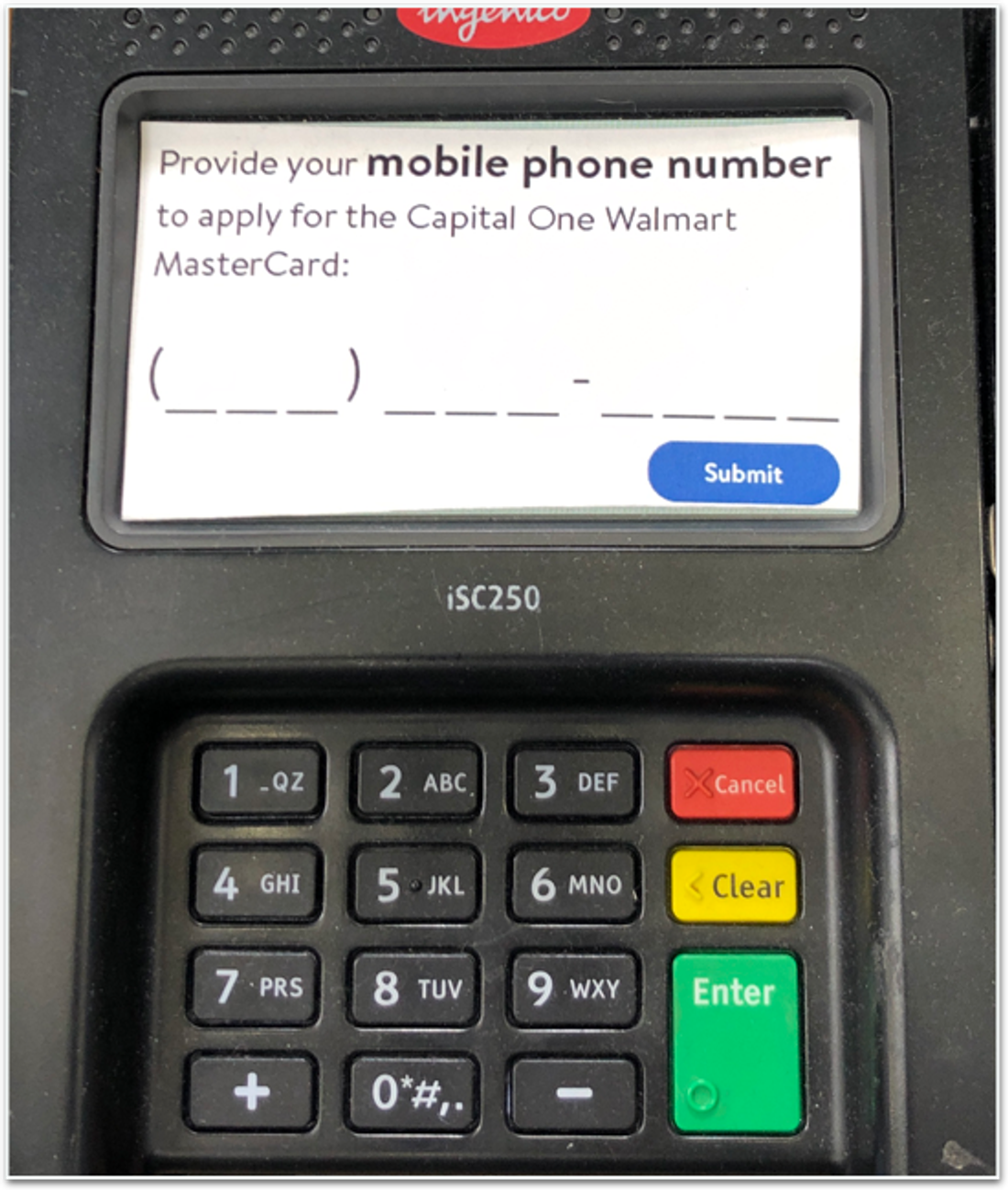

Myself and two dedicated researchers prioritized our research needs, planned multiple studies, and carried them out with some help from our partners in the stores. Our first study tested the application process while in the checkout lane, as our original strategy called for. That strategy shifted drastically when we discovered the application was not only too time consuming (10-12 minutes) and costly to the organization, but also a hinderance to our customers who are often juggling groceries and multiple kids. We shifted to a TXT-to-Apply strategy with our in-store marketing materials, and began efforts to shore up any losses with more in-app experiences.

As a testament to the sheer enormity of the amount of work this entailed, I’ve included a snapshot of the primary journeys here. Further detail follows below.

The Ask

Launch a rewards program that offers our customers unique value and a reimagined experience.

Increase adoption of Walmart Pay, our proprietary payment platform that allows customers to pay for store purchase with their phone.

The Strategy

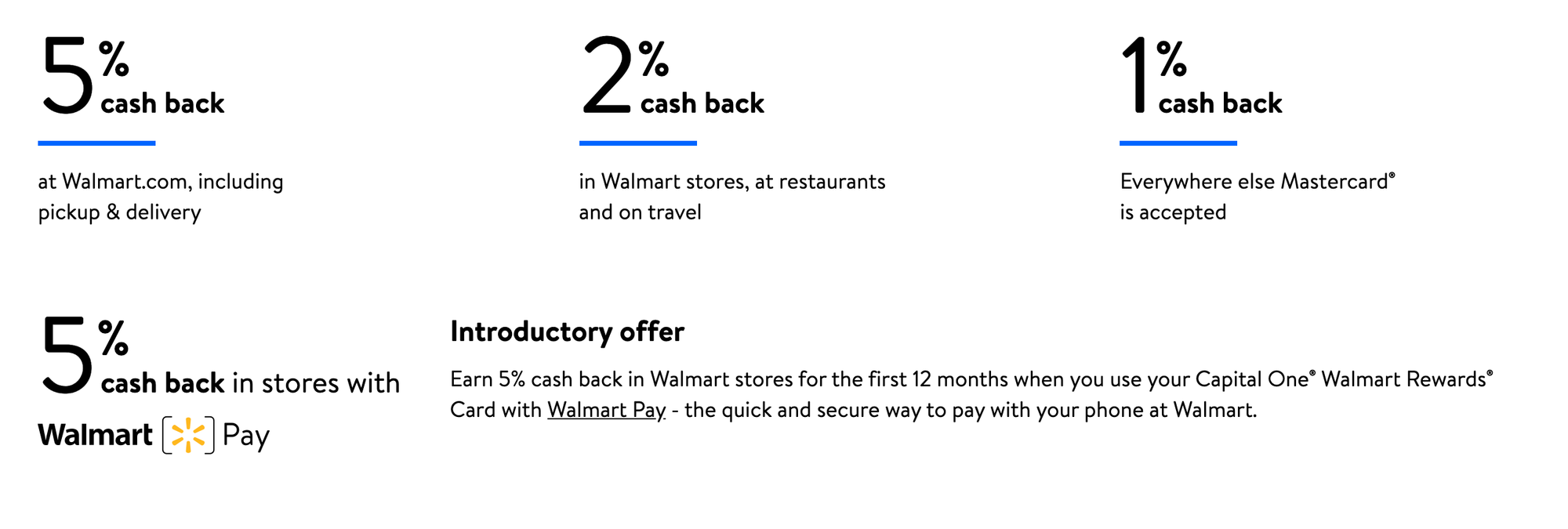

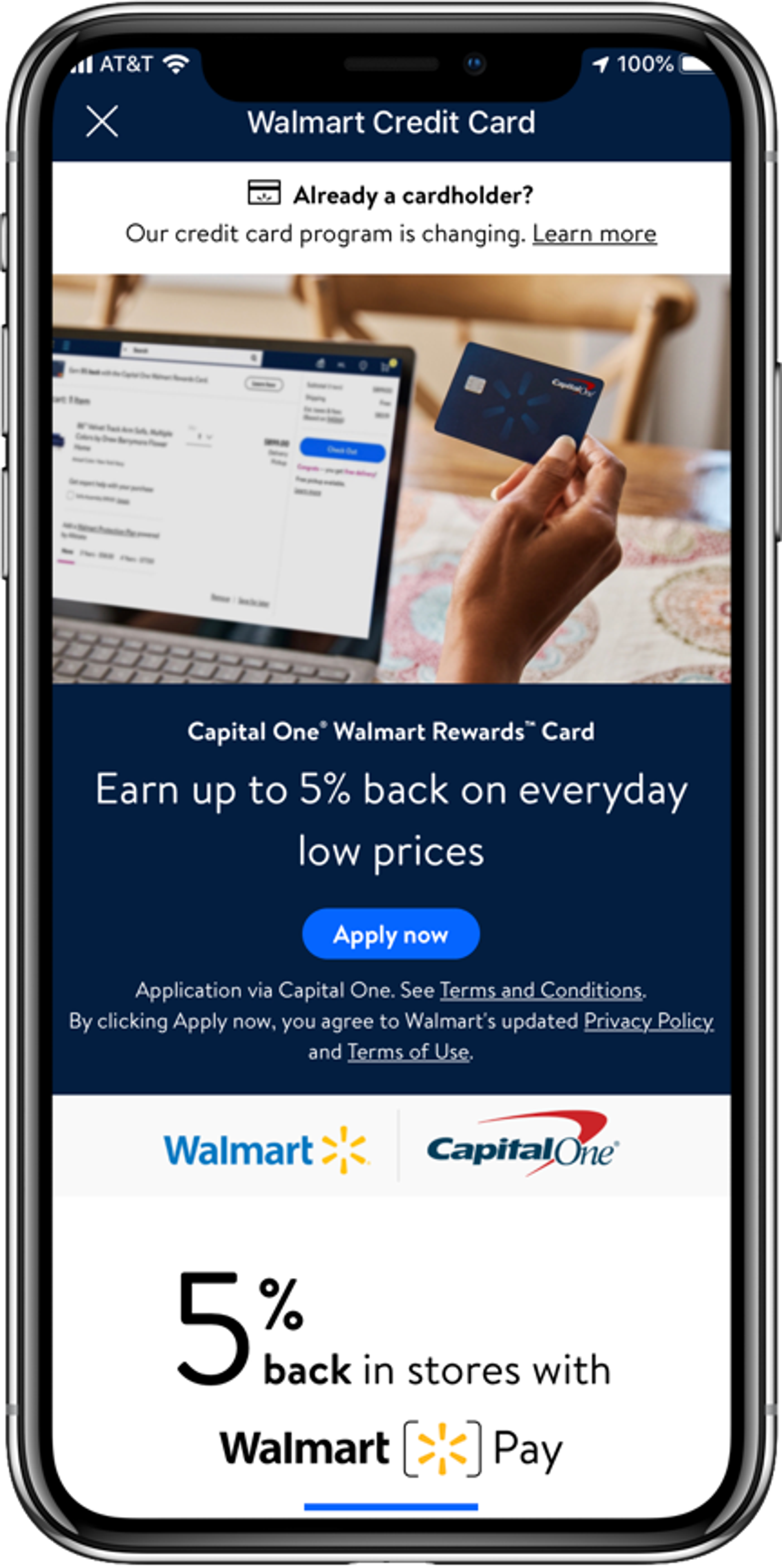

Our partnership with Capital One enabled us to offer a compelling value proposition to our customers:

5% back at Walmart

2% back on travel and dining

1% back anywhere Mastercard is accepted

A Win Win proposition

for customers

Earn 5% back on already low prices

Redeem earnings in any number of ways with Walmart or Capital One

Gain access to credit monitoring, money coaching and digital tools

for Walmart

Increased competitiveness in price leadership

Incentivized gateway into Walmart's omni channel tools

Gives us more data on our customers, with an ability to serve them even better

Challenges

Compelling, yet nuanced value proposition

(This is actually the layout we used on the landing page to describe the value proposition.)

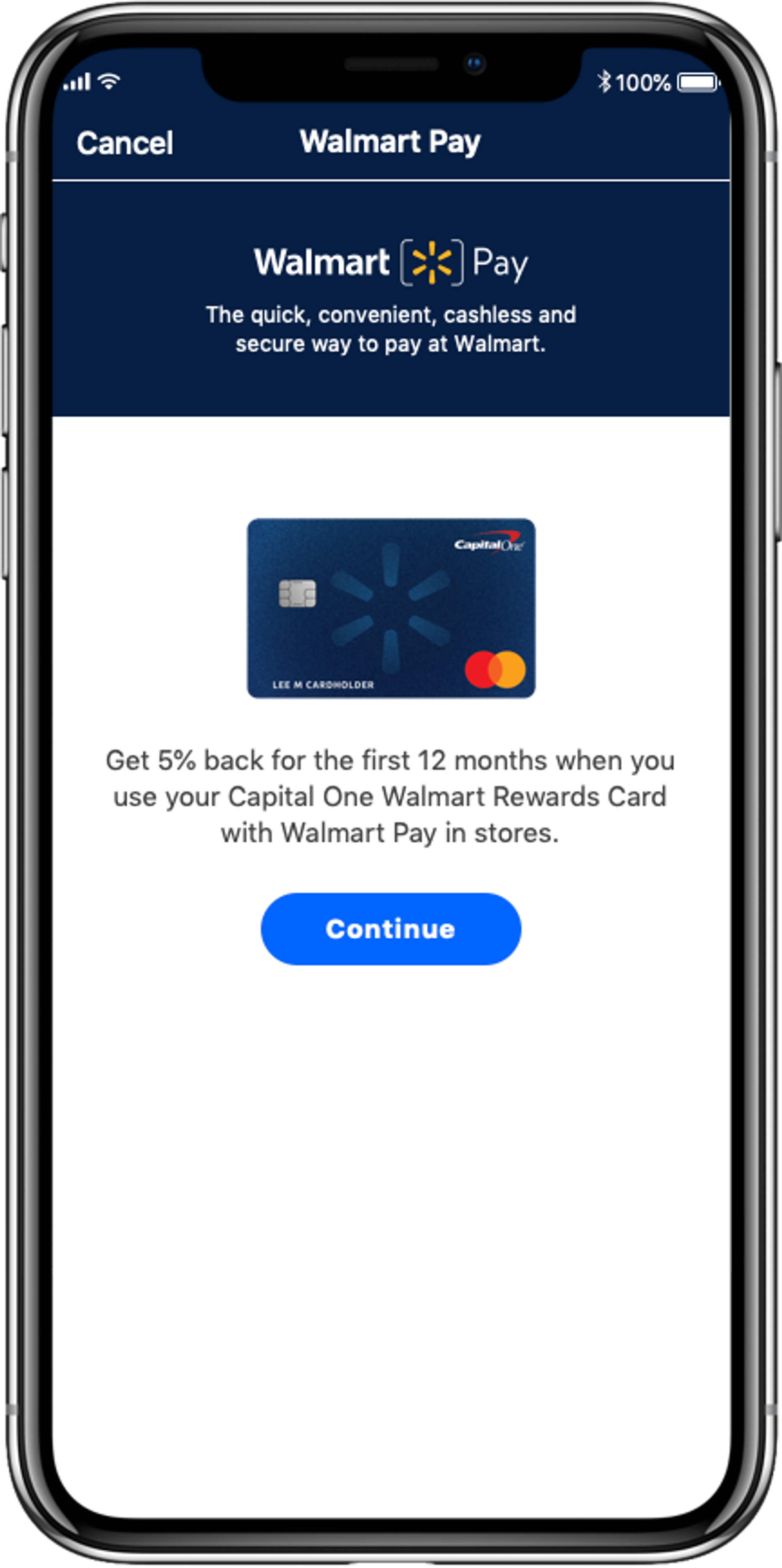

The offer was reliant on the customer using Walmart Pay, but few people knew what that was.

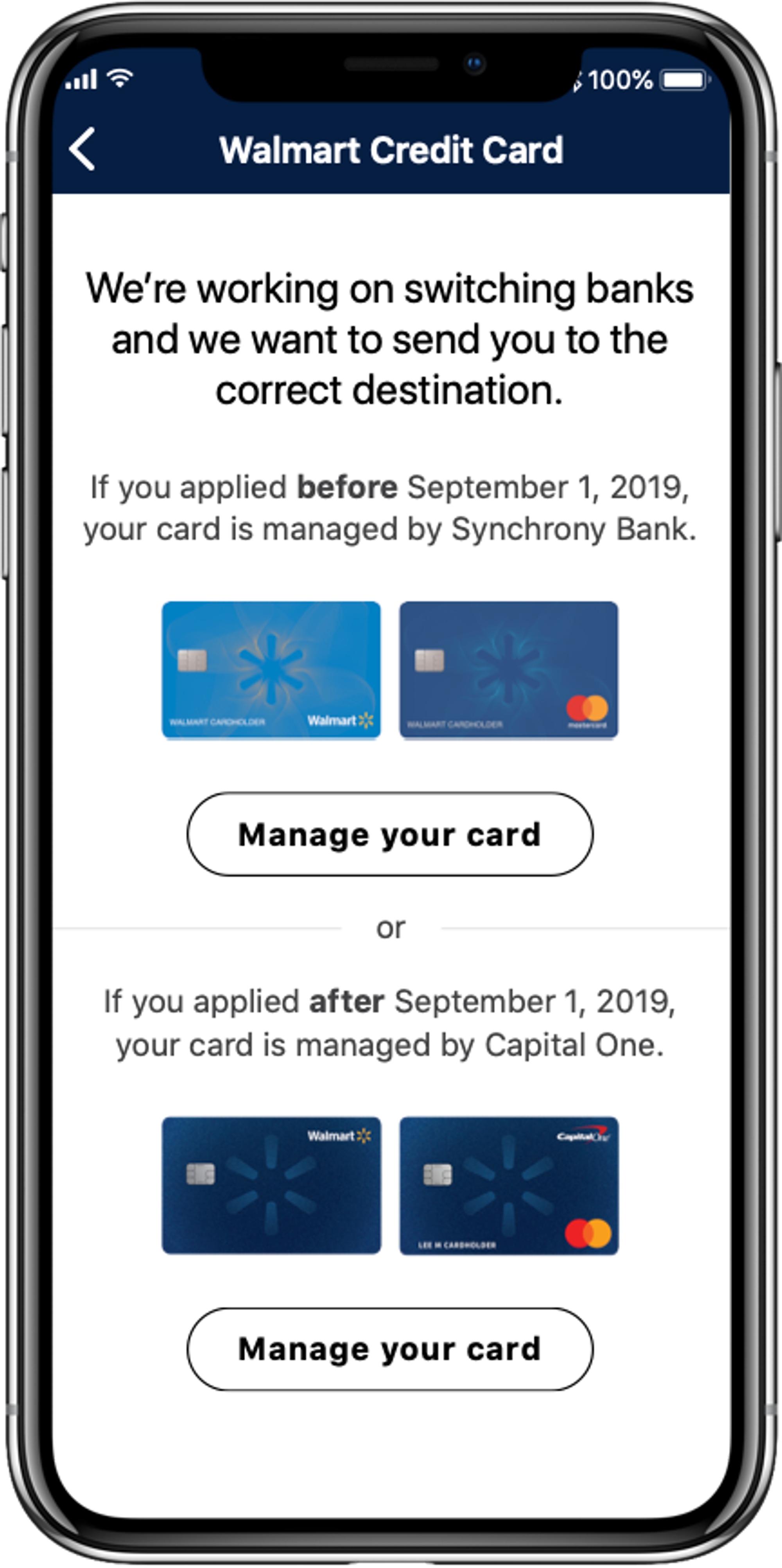

And lastly, we had an existing 10 million card members on the old Walmart card that we risked losing in the transition.

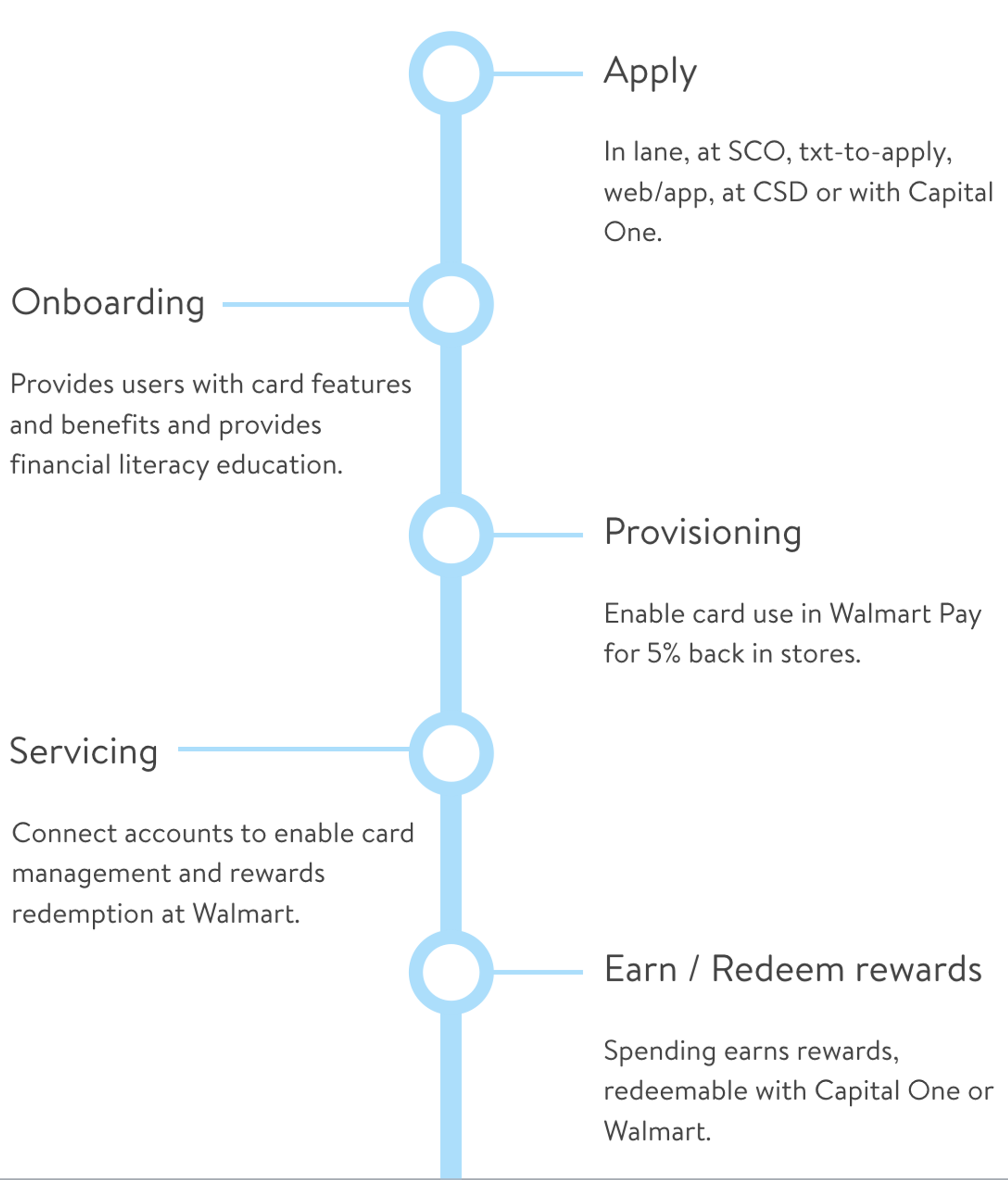

Customer journey

Apply and buy with magic link

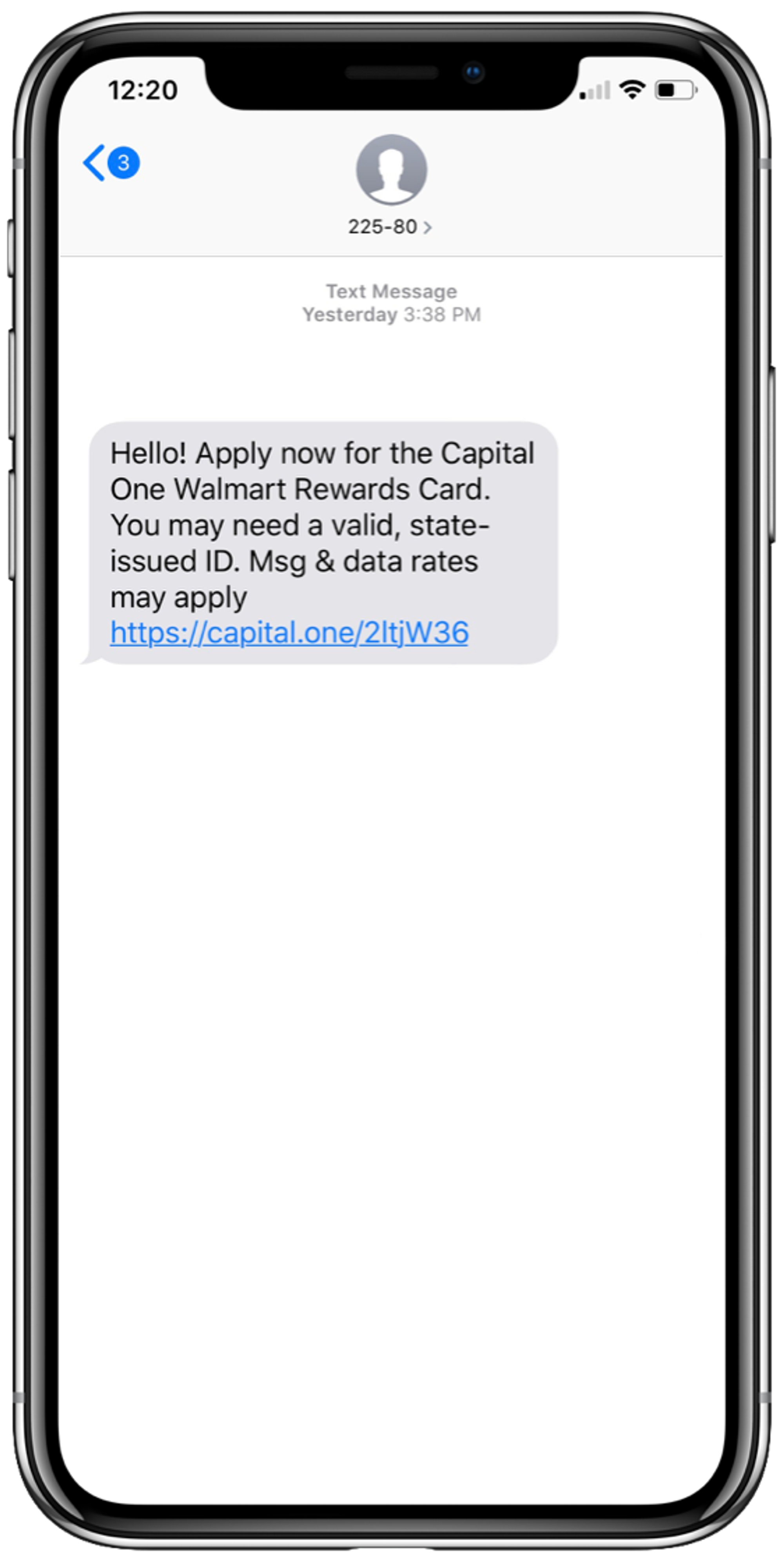

When applying for the card in stores, customers use their own device. The process is initiated with a txt-to-apply mechanism.

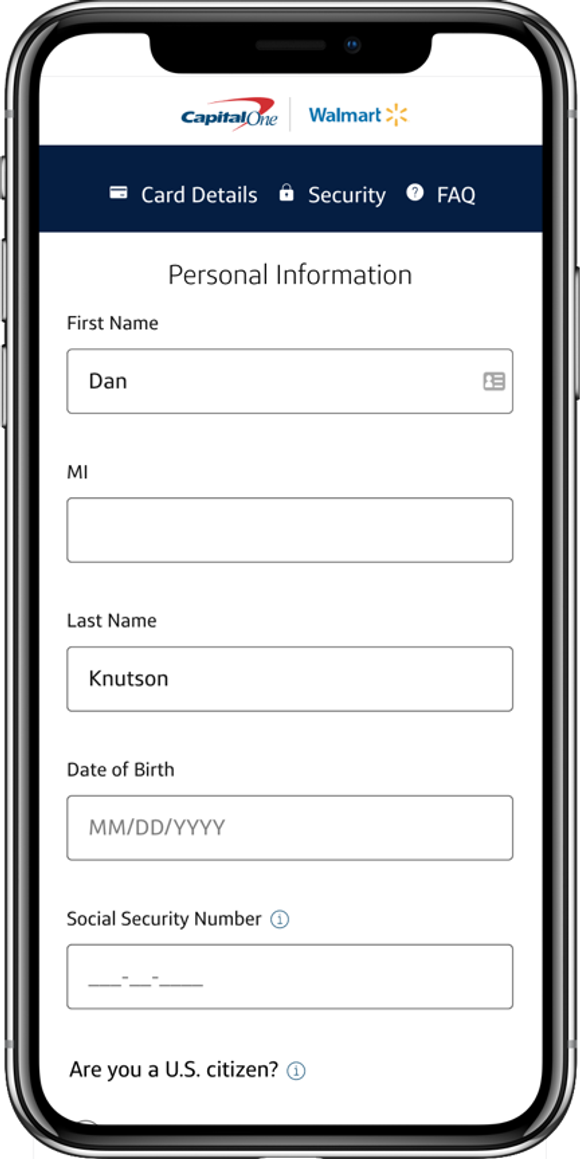

To keep lanes moving, we allowed for direct application without a walmart.com account and pre-filled their application with billing address data from the customer's network provider.

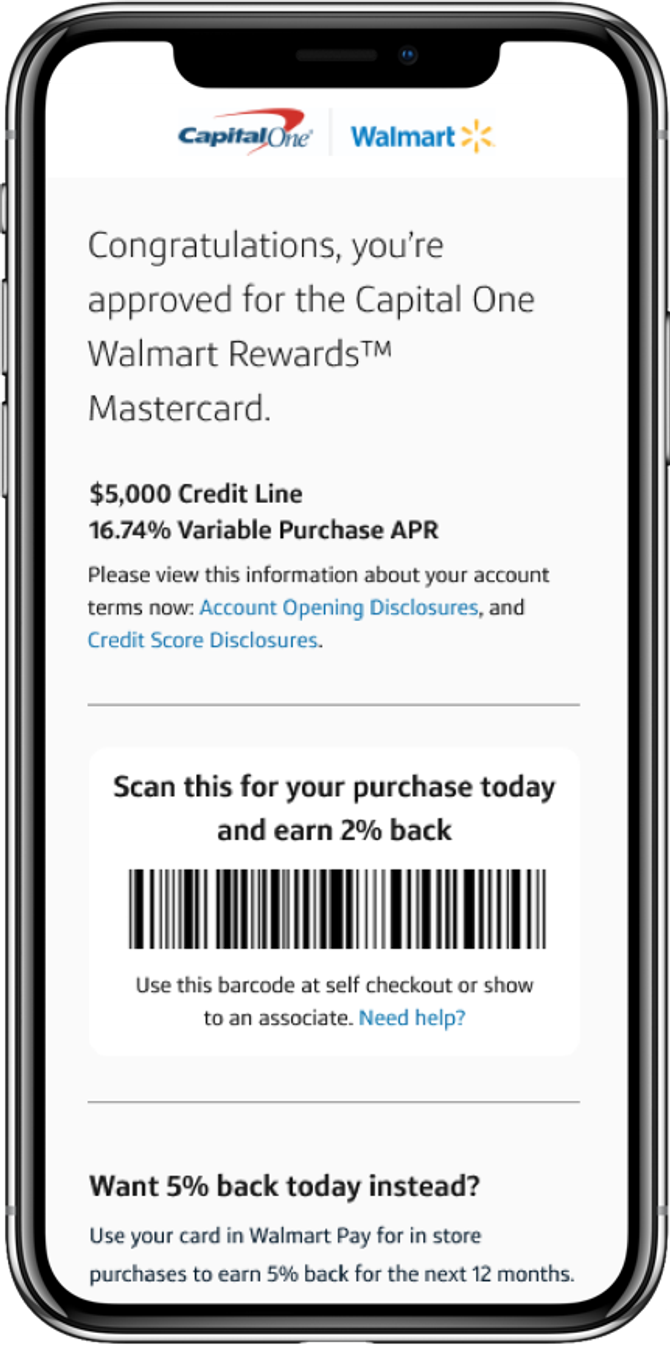

Upon approval a temporary shopping pass is issued, enabling immediate purchase.

The new card is then immediately provisioned into the user's walmart.com account, too.

This was an industry first.

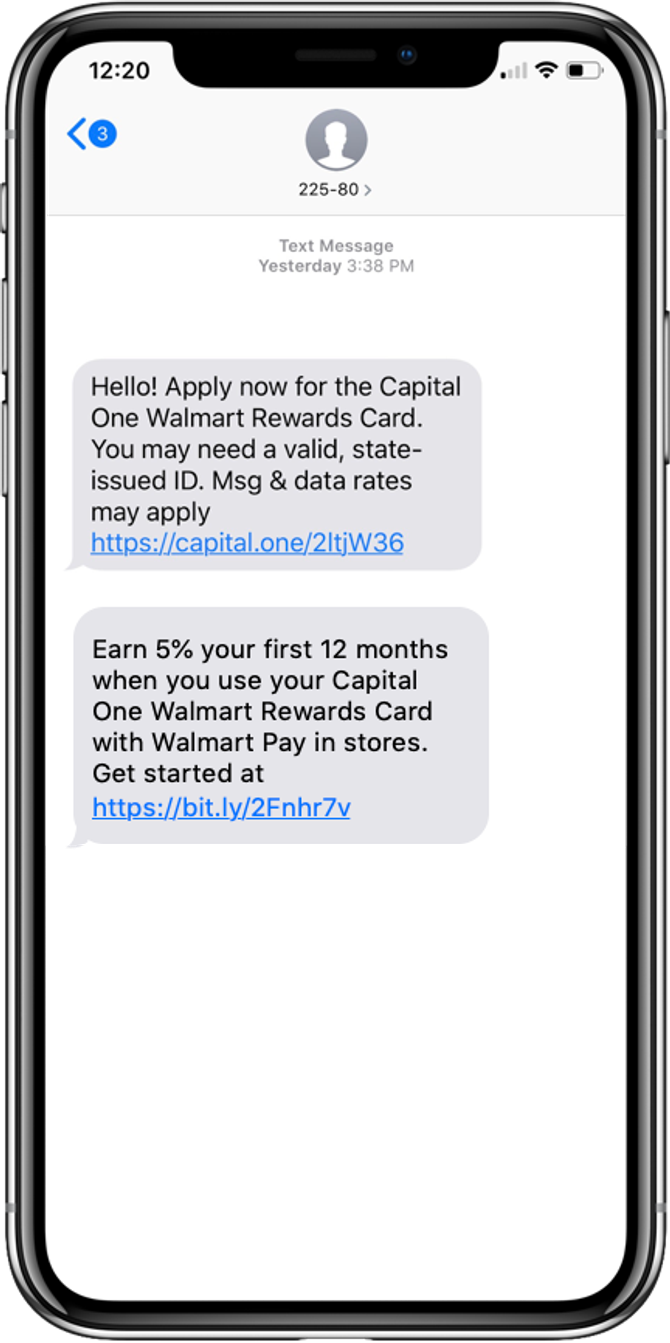

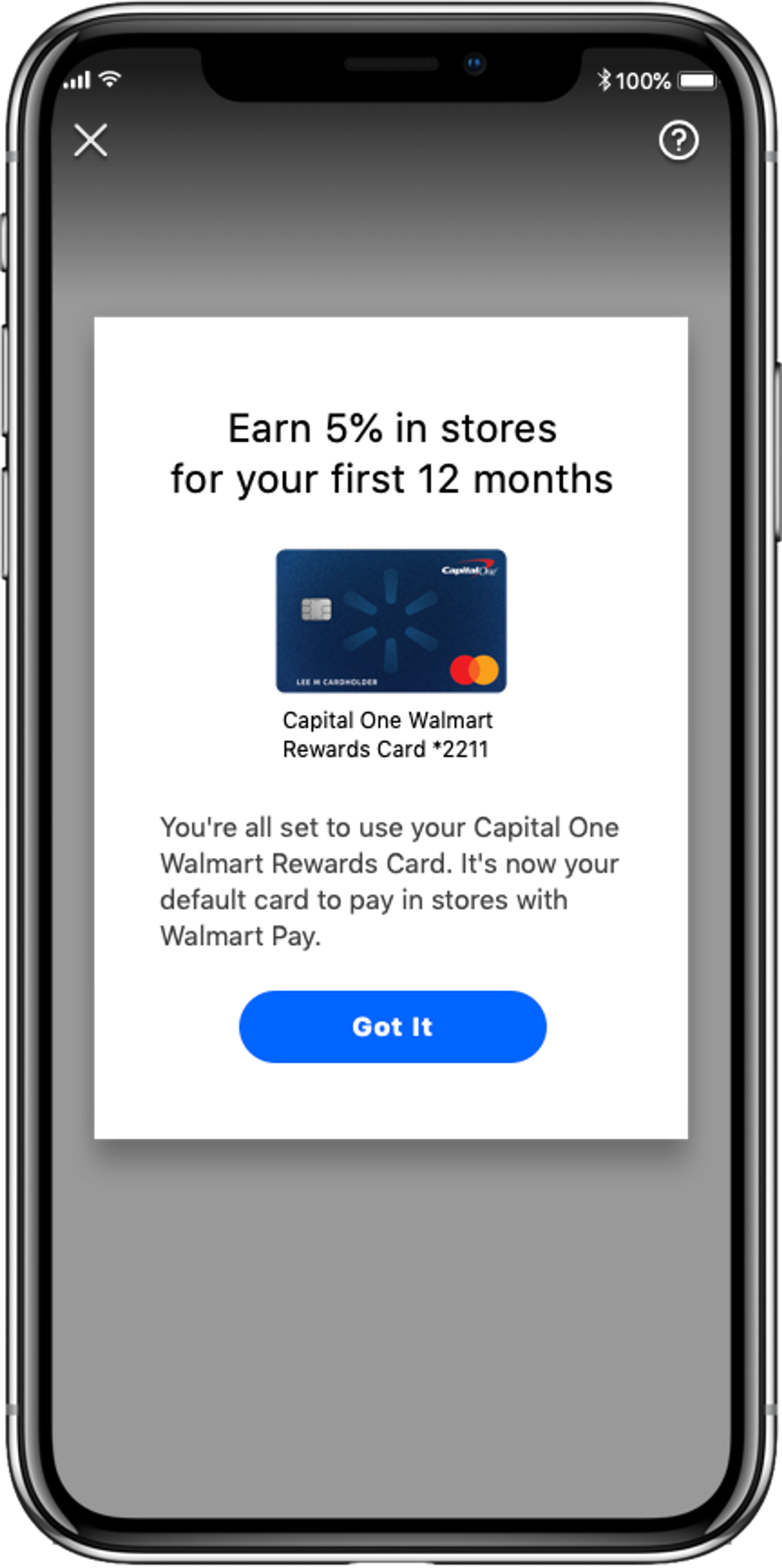

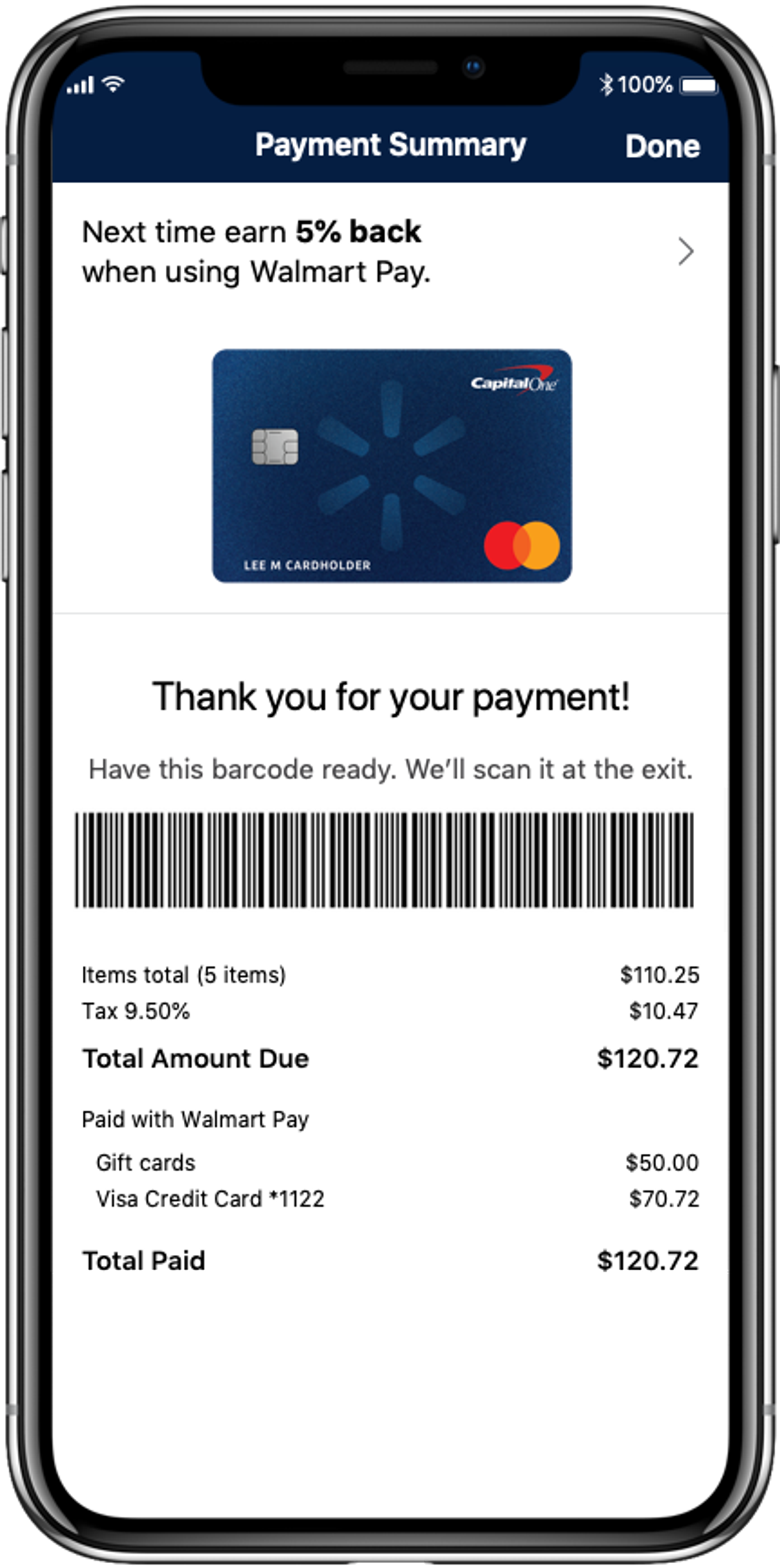

A "magic link" arrives 15 minutes later getting the customer setup with Walmart Pay to enable 5% back while shopping in stores, but also so Walmart can tie the card to the user's profile and introduce them into our suite of omni channel digital products.

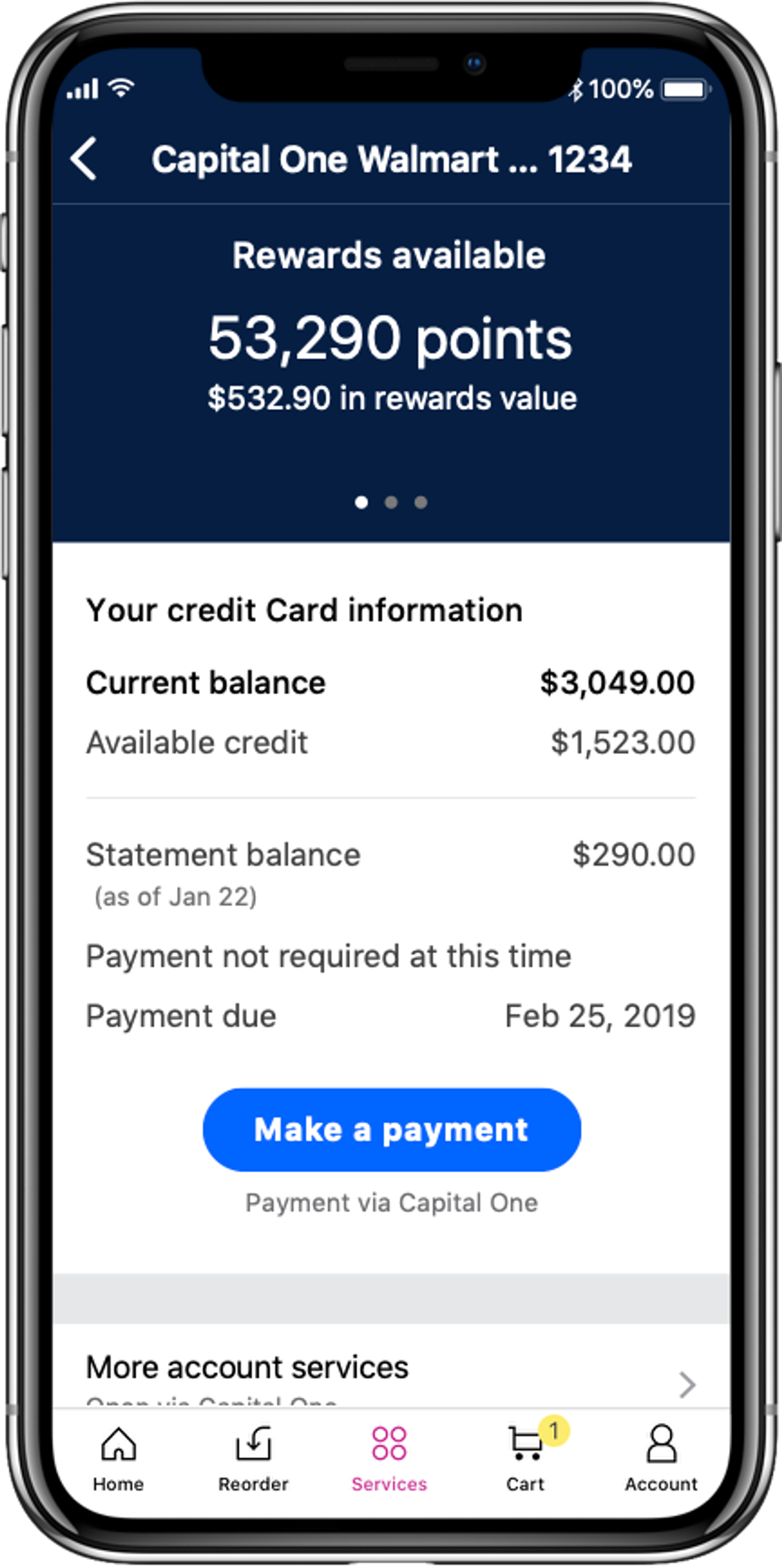

Servicing and Pay with Points

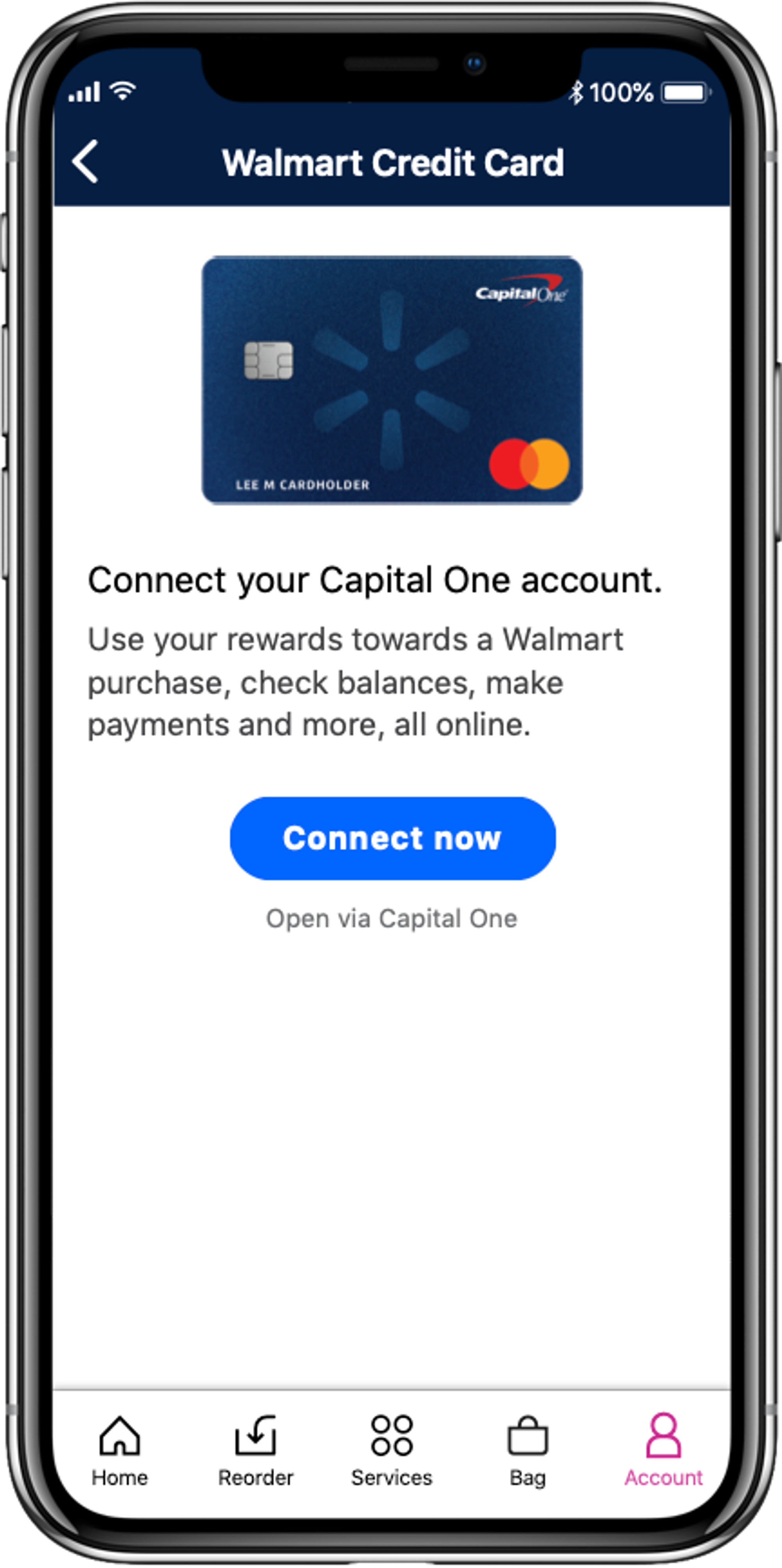

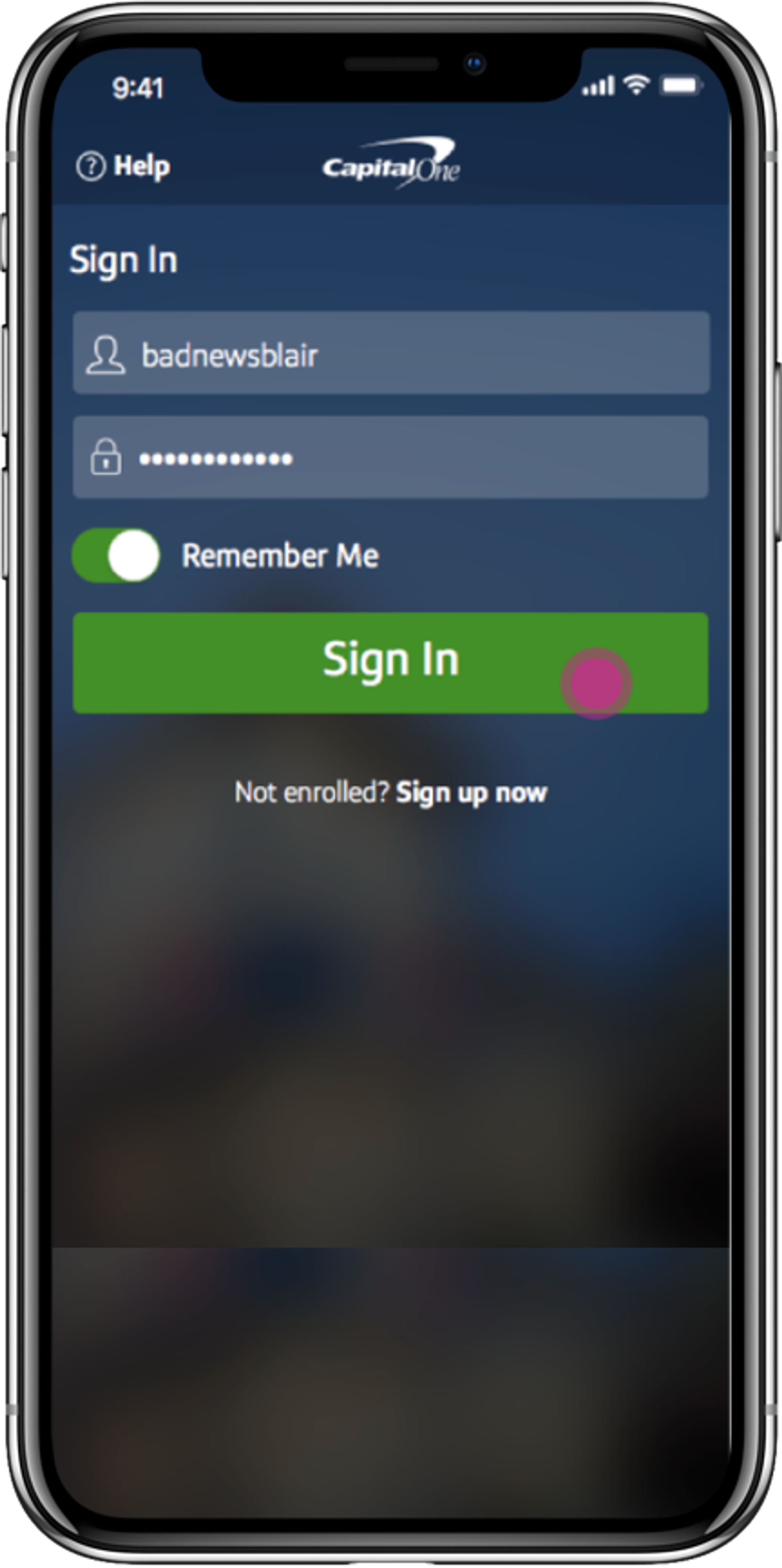

Connecting Walmart and Capital One accounts offers an unprecedented service offering.

Customers can manage their account on either property.

The enabled data sharing then allows Walmart to strengthen its personalization model and opens to the door to additional service offerings.

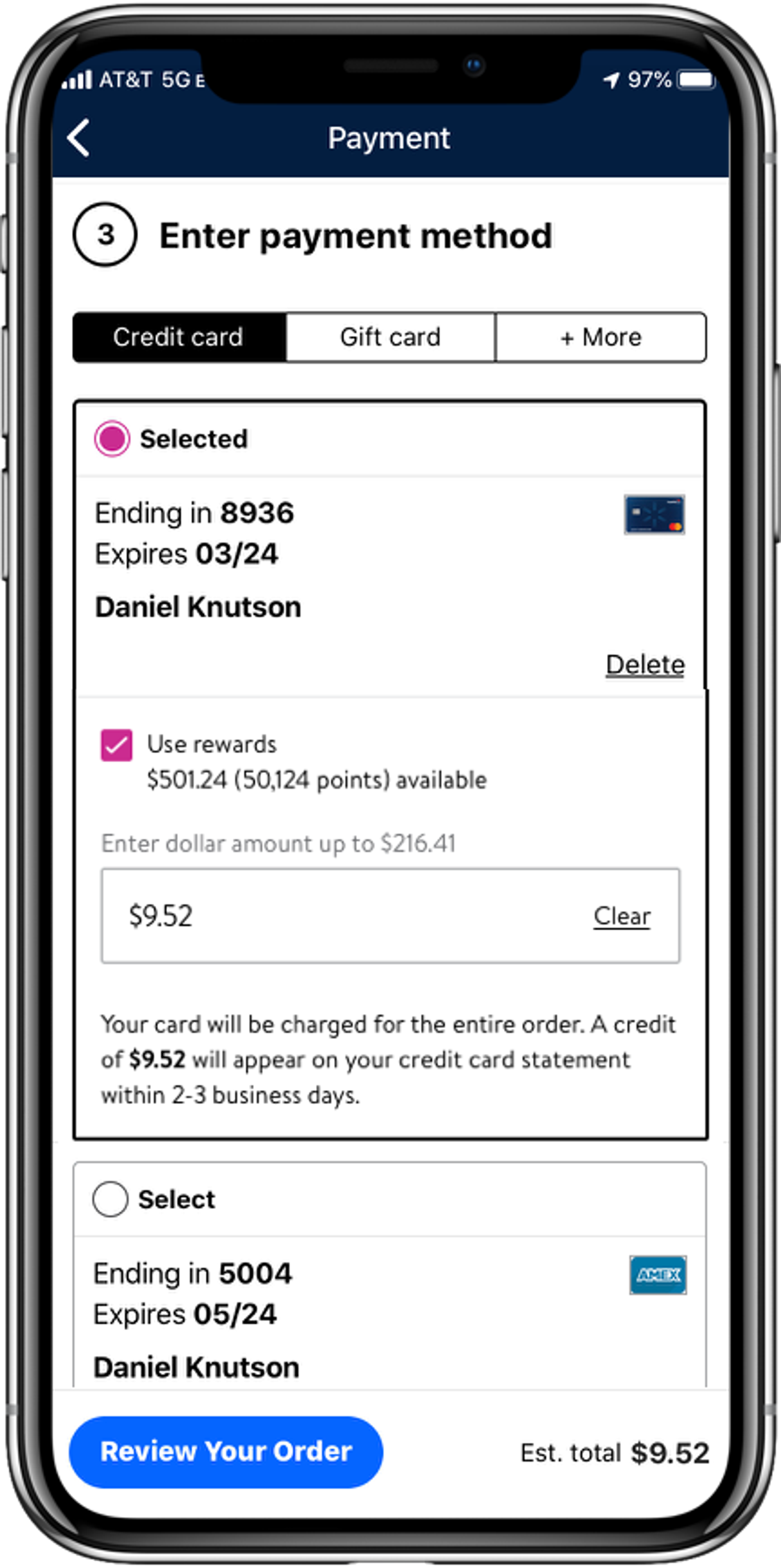

Servicing also enables a Pay With Points function.

Working across the organization, we created an integrated experience enabling card members to use their rewards towards purchases at Walmart. This was particularly sensitive because anything that touches the cart in e-commerce is considered sacred ground - you cannot adversely affect conversion!

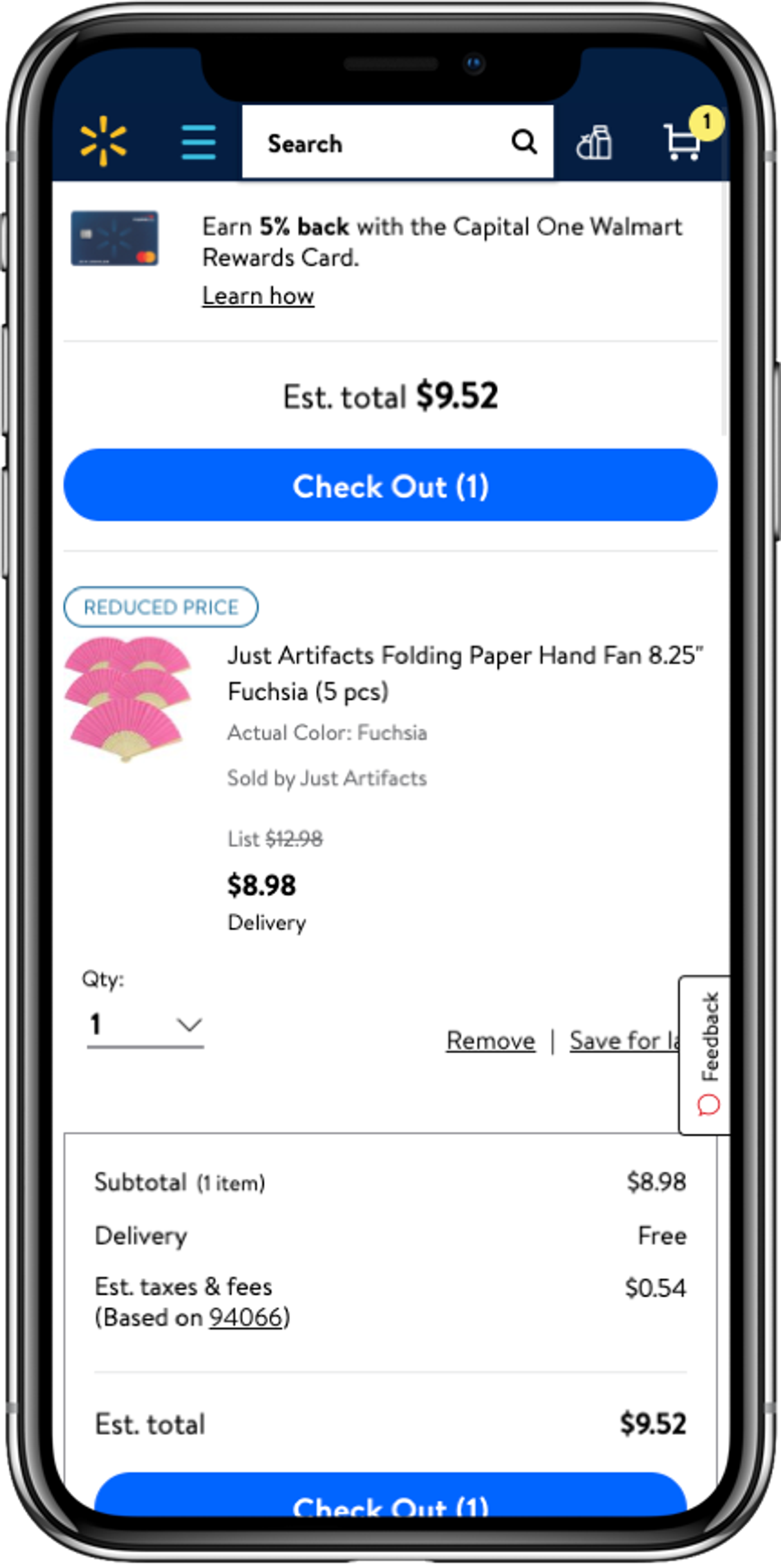

Integrated experience touchpoints

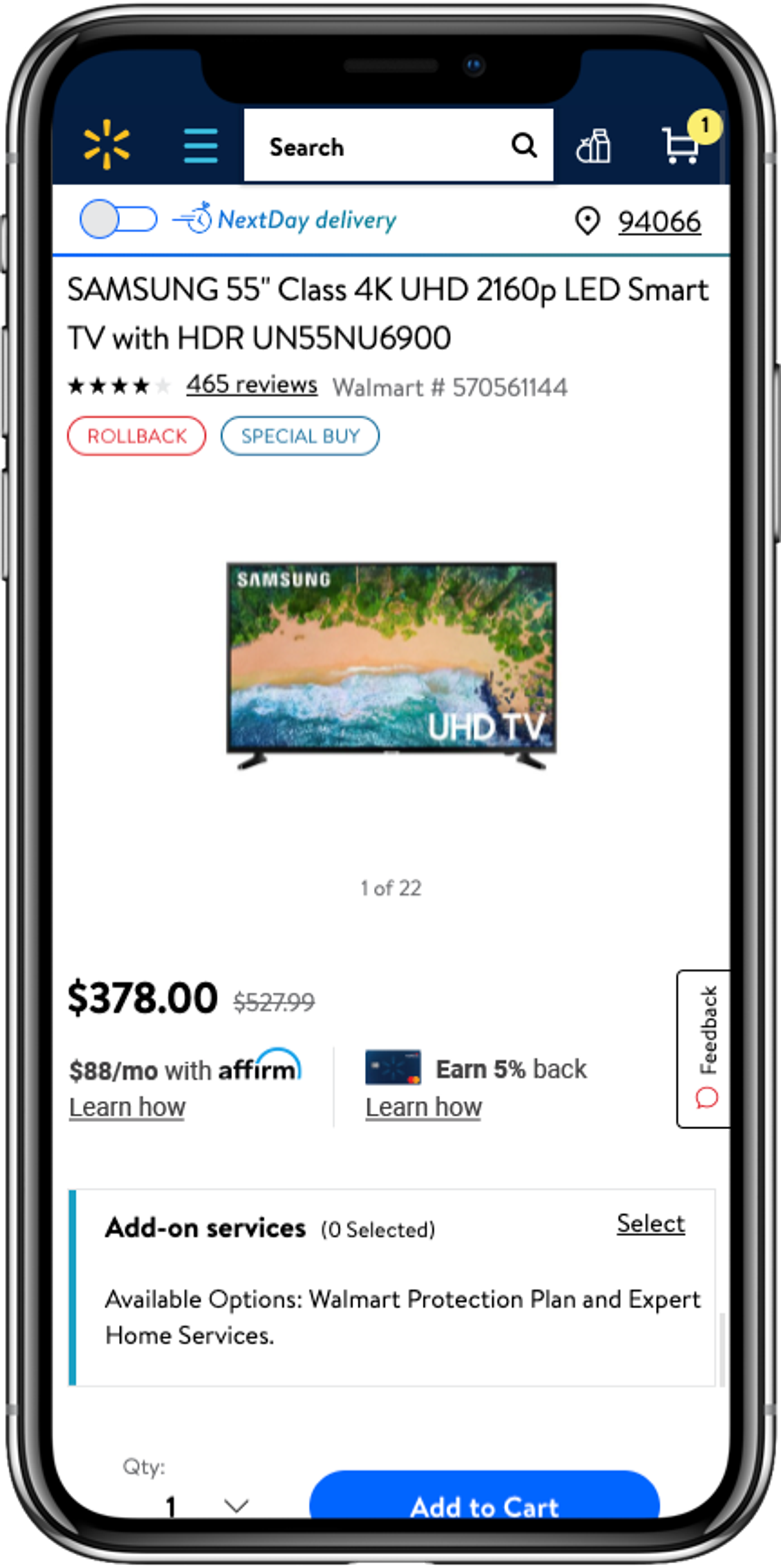

We worked across multiple teams to secure a web of evergreen entry points into the experience - in the cart, prominent placement in the hamburger menu, on item detail pages, our in-store assistant and thank you screen after checkout online or in the stores with Walmart Pay.

All entry points lead to our landing page, serving existing card members and working to compel prospects to apply.

Conversion and Dual Servicing

In addition to a comprehensive communications effort, we created an entirely wholistic conversion experience for current card holders to coincide with those planned messages.

Landing page conversions were up 3x compared to prior landing page.

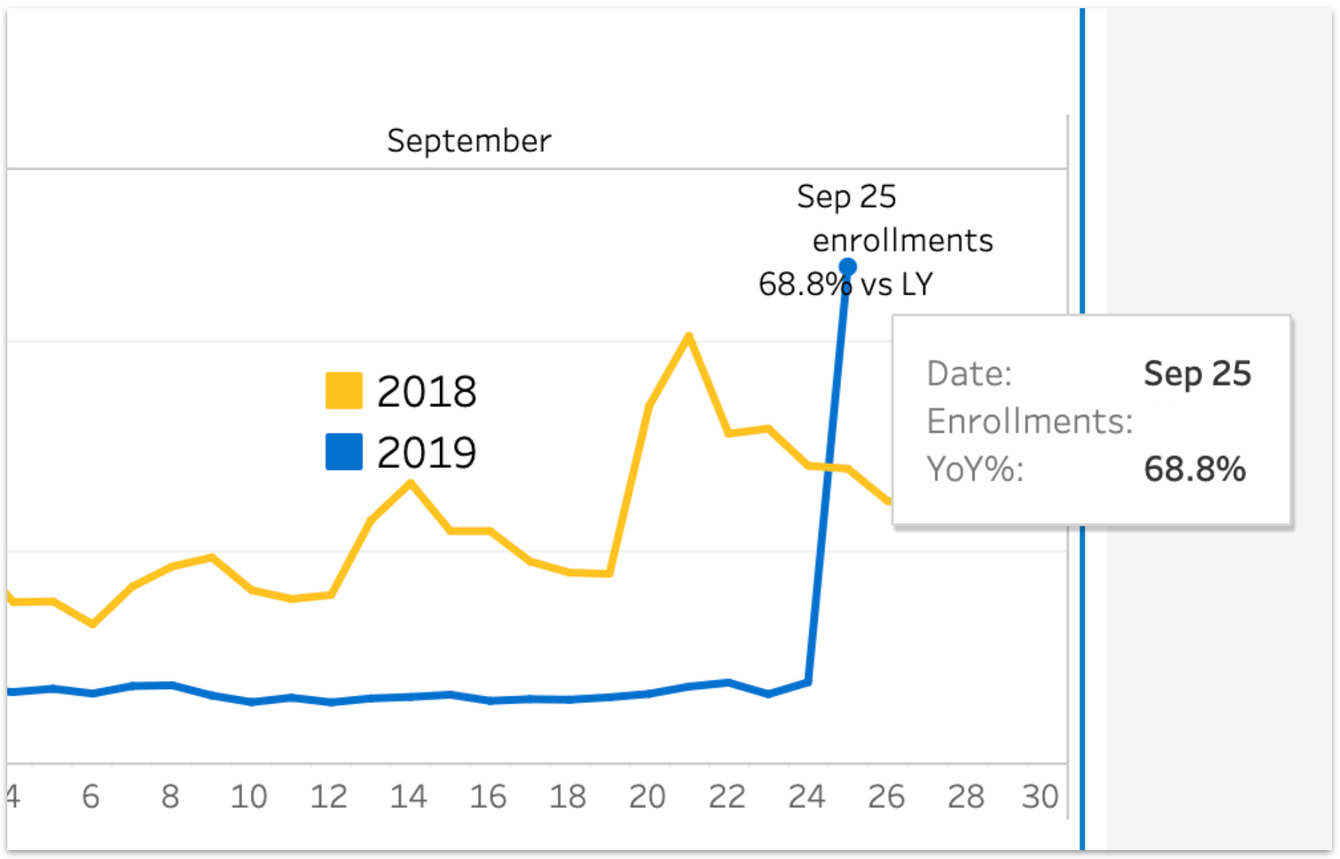

Walmart Pay adoption was stellar, illustrated by the chart below.